Daijiworld Media Network - New Delhi

New Delhi, Sep 3: Finance Minister Nirmala Sitharaman on Wednesday emphasized that the latest round of Goods and Services Tax (GST) reforms go beyond mere rate rationalisation, describing them as part of a broader structural overhaul aimed at simplifying taxation and supporting key sectors of the economy.

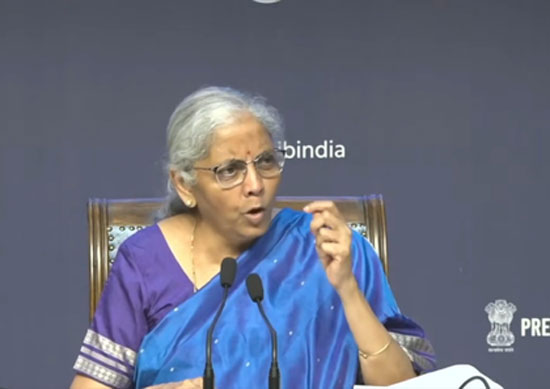

Briefing the media following the 56th meeting of the GST Council, the Finance Minister said all decisions were made with complete consensus among Council members, including the much-discussed rate rationalisation. “These reforms are not only about adjusting tax rates but correcting systemic issues like the inverted duty structure,” Sitharaman said.

The sweeping changes are aimed at benefiting a wide range of sectors—from agriculture and healthcare to education, automobiles, and consumer goods. According to the Finance Minister, “in common man and middle-class items, there is a complete reduction,” and Prime Minister Narendra Modi was keen that the benefits of these cuts reach the public as quickly as possible.

Key daily-use items such as hair oil, soap bars, toothpaste, bicycles, and tableware will now be taxed at just 5 per cent. Similarly, all cars under 1200cc and motorcycles under 350cc will attract a reduced GST of 18 per cent.

Agriculture, one of the government's focus areas, sees substantial tax relief. GST on items like tractors, horticultural and forestry machinery, soil preparation tools, harvesting and crushing machines, straw and grass movers, and composting machines has been slashed from 12 per cent to 5 per cent.

Healthcare products and farming tools are not the only beneficiaries. In a move targeting harmful substances, GST on pan masala, gutkha, cigarettes, chewing tobacco (like zarda), and unmanufactured tobacco will now be applied on the retail sale price (RSP) instead of the transaction value, ensuring tighter control over taxation and revenue. These products, along with caffeinated and carbonated beverages, will be subject to a special rate of 40 per cent.

However, the revised GST rates on all goods—excluding tobacco-related items and pan masala—will come into effect from September 22.

FM Sitharaman stressed that the changes were made with an intent to simplify processes, reduce costs for the end consumer, and empower small businesses—aligning closely with the broader goals of Aatmanirbhar Bharat.

The GST Council also passed a number of trade facilitation measures aimed at making compliance easier and improving the overall ease of doing business.