Media Release

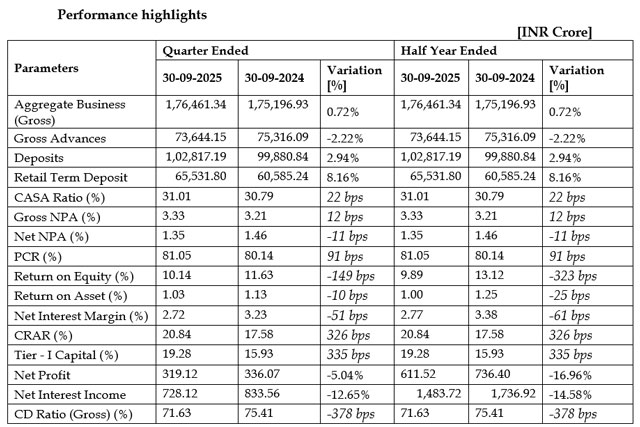

Mangaluru, Nov 8: Karnataka Bank posted an impressive quarterly net profit of Rs 319.12 crore, for the quarter ended Sept-2025. The net profit improved by 9.1% as compared to the quarter ended June 2025 with a net profit of Rs. 292.40 crore.

In the meeting of the board of directors held today at Mangaluru, the board has approved the financial results for the quarter and the half year ended September 30, 2025. Furthermore, for the half year ended September 2025, the net profit stood at Rs 611.52 crores, as against Rs 736.40 crores for half year ended September 2024.

For the quarter ending September 2025, the Net Interest Income stood at Rs 728.12 crore. The NPAs have further moderated as the GNPAs reduced to 3.33% as against 3.46% as of June 2025, while NNPAs also reduced to 1.35% as against 1.44% as of June 2025.

The aggregate business of the Bank stood at Rs 1,76,461.34 crore (on a gross basis) for Q2FY26 compared to Rs 1,77,509.19 crore in Q1FY26. The aggregate deposits of the bank stood at Rs 1,02,817.19 crore in Q2FY26 as against Rs 1,03,242.17 crore as of Q1FY26. Bank’s gross advances stood at Rs 73,644.15 crore in Q2FY26 when compared to Rs 74,267.02 crore as of Q1FY26, however there was a growth in the RAM (Retail, Agri & MSME) segment of the Bank. The CD ratio (gross) of the Bank stood at 71.63%.

The bank's capital adequacy ratio stood at 20.84% compared to 20.46% as of June 2025.

In line with RBI’s revised draft guidelines on Liquidity Coverage Ratio (LCR), the bank has computed the same as on September 30, which stands at 188.16%.

Announcing the results for Q2 FY26 at the bank’s head office at Mangaluru, Raghavendra S Bhat, managing director & CEO, said,

“During the quarter, the bank witnessed a marginal QoQ decline in topline performance but achieved improvement in asset quality. Our focus will continue to remain on the RAM (Retail, Agri, and MSME) segments, alongside strengthening our base of low-cost deposits. These efforts are expected to enhance spreads and, in turn, improve NII.

The bank is also actively working to build a high-quality credit portfolio, with initiatives across all levels aimed at minimizing slippages and recovering non-performing assets.

Additionally, our Analytical Centre of Excellence (ACoE) has been instrumental in driving data-led transformation through the implementation of tools such as retail loan propensity, micro market analysis, deposit propensity, primary bank index, collection prioritization, and behavior scorecard. These tools have been integrated into our business processes, embedding analytics into decision-making and supporting predictive and strategic analytics use cases to enhance efficiency and insight across the Bank.

Our mission and vision remains clear and steadfast as we continue to pursue, our objectives with renewed focus and energy”.