The crypto market continues to evolve rapidly. With prices fluctuating and investor sentiment shifting almost daily, traders and long-term holders alike are constantly asking the same question: What is the best crypto to buy right now?

In this article, we dive deep into the three leading cryptocurrencies by relevance and market momentum: Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP). Using current market data, technical indicators, support and resistance levels, and expert insights, we evaluate which coin holds the most promise right now.

Whether you are looking for your next short-term trade or a long-term investment, this detailed price prediction and analysis will help guide your decision. Let’s start with the king of crypto, Bitcoin.

Bitcoin (BTC) Price Prediction

Current Market Status

The BTC USDT trading pair is currently moving within a very tight range, hovering between $116,000 and $120,000. This range has held firm for over two weeks, creating what many analysts describe as a consolidation phase. Consolidation often occurs after a large price movement and suggests that the market is taking a breather before the next major move.

This can be a frustrating time for traders seeking volatility, but historically, these kinds of consolidations often precede powerful breakouts.

Technical Analysis

- Support level: $116,000

- Resistance level: $120,000

- Relative Strength Index (RSI): Neutral, hovering around 50

- MACD (Moving Average Convergence Divergence): Slightly bearish crossover

Bullish Scenario

If Bitcoin can break and close above the $120,000 resistance level with strong volume, it may trigger a run toward the next major resistance near $125,000. Such a breakout could signal renewed confidence from institutional investors and retail traders alike.

Bearish Scenario

On the other hand, if Bitcoin falls below $116,000, it could open the door for a steeper pullback toward $112,000 or even $108,000. Technical indicators suggest weakening momentum, so traders should be cautious until a decisive move occurs.

Investment Outlook

Bitcoin remains the most stable and widely adopted cryptocurrency. For long-term investors, this consolidation may be a healthy reset. However, short-term traders looking for volatility in major trading pairs like BTC USDT may prefer to wait for a confirmed breakout before re-entering the market.

Ethereum (ETH) Price Prediction

Current Market Status

Ethereum is currently leading the pack among the top three cryptocurrencies. After reclaiming the important $3,730 level, ETH/USDT surged past $3,800 and is now eyeing the psychological milestone of $4,000.

This renewed strength comes as Ethereum continues to gain traction in the world of decentralized finance, smart contracts, and institutional interest.

This renewed strength comes as Ethereum continues to gain traction in the world of decentralized finance, smart contracts, and institutional interest.

Technical Analysis

- Support level: $3,730

- Resistance level: $4,000

- Relative Strength Index (RSI): Trending higher toward overbought territory

- MACD: Bullish momentum building

Bullish Scenario

A break above $4,000 would be highly significant from both a technical and psychological standpoint. Such a move could propel ETH toward the next resistance around $4,200. Strong fundamentals and growing investor interest make this scenario quite plausible in the near term.

Bearish Scenario

If ETH fails to break and hold above $4,000, we could see a short-term dip back toward $3,730 or even $3,500, which has been a historically important level of support.

Why Ethereum Looks Strong

Ethereum benefits from several bullish factors:

- Continued growth in DeFi (Decentralized Finance) platforms built on the Ethereum network

- Anticipation of a spot ETH ETF approval

- Strong developer community and ongoing upgrades to improve scalability and transaction speed

Investment Outlook

Ethereum appears to be the most promising of the three cryptos at the moment. With strong price momentum, positive sentiment, and clear catalysts for growth, ETH is well-positioned for both short- and long-term gains.

Ripple (XRP) Price Prediction

Current Market Status

Ripple’s XRP token has had a rollercoaster year. Recently, it bounced from a key Fibonacci retracement support level at $2.99 and is now trading around $3.25. Although this rebound has sparked interest, XRP still faces significant resistance at the $3.40 level.

Technical Analysis

- Support level: $2.99

- Resistance level: $3.40

- RSI: Recovering from oversold conditions

- MACD: Neutral, with a slight upward tilt

Bullish Scenario

If XRP can break and sustain above the $3.40 resistance, it could open the door for a rally toward $3.70 and possibly $4.00. Traders monitoring XRP/USDT are watching closely for confirmation, as this level has historically acted as a pivot for stronger upward moves.

Bearish Scenario

Failure to hold above $3.25 could lead to a retest of the $2.99 support. If that fails, XRP might retrace further toward $2.80, where the next support zone lies.

What Is Driving XRP’s Momentum

Ripple continues to expand its payment network and is gradually regaining confidence after regulatory uncertainty. As legal clarity improves and more financial institutions adopt RippleNet for cross-border payments, XRP’s long-term value proposition strengthens.

Investment Outlook

XRP is a more speculative investment compared to BTC and ETH, but it also offers higher potential returns if momentum builds. It is best suited for investors with a higher risk tolerance and a medium- to long-term horizon.

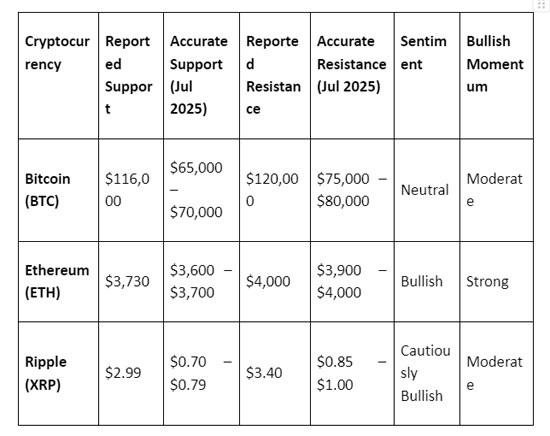

Comparative Analysis

Let’s compare the three assets side by side:

Ethereum currently has the strongest technical and sentiment profile. Bitcoin remains steady, acting as the market anchor, while XRP is attempting to rebuild momentum but still faces significant resistance.

Expert Insights and Market Sentiment

Crypto analysts are divided but mostly optimistic:

- Several experts believe Ethereum has the best near-term setup and could break above $4,000 soon.

- Bitcoin’s consolidation suggests a big move is coming, but the direction is still unclear.

- XRP has a loyal community and potential catalysts, but needs stronger confirmation of trend reversal.

Social media sentiment for Ethereum is trending upward, with more discussions centered on the possibility of a spot ETH ETF approval. Bitcoin remains the most discussed coin but with more neutral tone, while XRP is gaining ground among altcoin enthusiasts.

On-chain data supports this narrative. Ethereum’s network activity has risen sharply, and wallet addresses are increasing. Bitcoin’s metrics remain stable, while XRP’s volume and active addresses are slowly recovering.

Best Crypto to Buy Right Now: Our Verdict

After weighing the data, technical indicators, and market sentiment, Ethereum (ETH) stands out as the best crypto to buy right now.

Here’s why:

- Strong price momentum and clear technical breakout potential

- Solid fundamentals with institutional interest and growing use in DeFi

- Relatively lower risk compared to XRP and better near-term upside potential than BTC

Bitcoin is still a smart choice for conservative long-term holders, especially if it breaks out of its range. XRP is promising but remains a more speculative bet until it clears key resistance levels.

Final Thoughts

Timing the crypto market is never easy, but aligning your decisions with solid analysis makes all the difference. Ethereum currently offers the best combination of bullish momentum, clear catalysts, and investor confidence.

That said, remember that the crypto market is highly volatile. Always use risk management strategies, diversify where appropriate, and never invest more than you can afford to lose.