Daijiworld Media Network - New Delhi

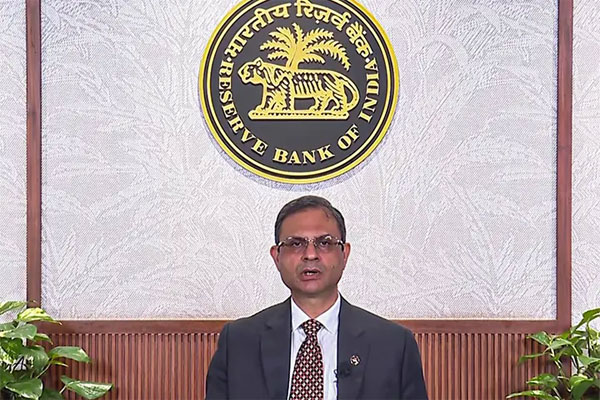

New Delhi, Aug 11: Reserve Bank of India (RBI) Governor Sanjay Malhotra on Monday clarified that minimum balance requirements for savings accounts are solely at the discretion of individual banks, and not under the regulatory purview of the central bank.

His comments came in response to concerns after ICICI Bank, India’s second-largest private lender, significantly raised its monthly average balance (MAB) requirements for new customers across all segments.

Speaking on the sidelines of a financial inclusion event in Gujarat, Malhotra stated,

“This decision does not fall under the regulatory domain. Different banks have set varying limits — some as low as Rs 2,000, others as high as Rs 10,000 — and some have removed it altogether.”

ICICI Bank’s Revised Minimum Balance Rules

Effective August 1, ICICI Bank’s revised norms include:

• New customers in metro/urban areas: Rs 50,000 MAB

• New semi-urban customers: Rs 25,000 MAB

• New rural customers: Rs 10,000 MAB

• Existing customers: MAB remains Rs 10,000 (metro/urban), Rs 5,000 (semi-urban/rural)

Customers failing to maintain the required balance will be charged a penalty of 6% of the shortfall or Rs 500, whichever is lower.

Additionally, customers are now allowed only three free cash deposits per month into their savings account. Further deposits will incur a charge of Rs 150 per transaction.

Contrasting Approaches Across the Banking Sector

ICICI’s move stands in sharp contrast to public sector and some private banks that have either lowered or eliminated such requirements:

• State Bank of India (SBI), the largest lender in the country, scrapped its minimum balance requirement in 2020.

• Most other banks maintain lower MAB thresholds, ranging between Rs 2,000 and Rs 10,000.

Summary

While ICICI Bank’s sharp hike in minimum balance norms has raised eyebrows, the RBI’s clarification confirms that there will be no regulatory intervention in such matters — leaving it to market dynamics and customer choice to guide future banking practices.