LIVE updates:

12:52 pm – Finance minister Nirmala Sitharaman announced that fish caught by Indian vessels beyond territorial waters will be made duty-free and that landing such catch at foreign ports will be treated as exports, with safeguards to prevent misuse.

12:50 pm – Finance minister Nirmala Sitharaman announced seven high-speed rail and rare earth corridors, raised FY27 capex to Rs 12.2 lac crore, pegged the fiscal deficit at 4.3 per cent of GDP, fixed the Budget size at Rs 53.5 lac crore, confirmed Rs 1.4 lac crore tax devolution to states, and said the new Income Tax Act, 2025, will take effect from April 1.

12:48 pm – The Centre announced support for states to set up three dedicated chemical parks under a cluster-based plug-and-play model, along with rare earth corridors and measures to promote mining, processing and manufacturing, to reduce import dependence and strengthen industrial supply chains.

12:44 pm – The finance minister proposed exempting basic customs duty on 17 medicines and adding seven rare diseases for duty-free personal imports of drugs and special medical foods.

12:42 pm – Buyback proceeds will be taxed as capital gains, STT on commodity futures was raised to 0.05 per cent, and the MAT rate was reduced to 14 per cent and made the final tax.

12:38 pm – The budget increased the outlay for the Electronics Components Manufacturing Scheme to Rs 40,000 crore and announced ISM 2.0, rare earth corridors and new chemical parks to strengthen domestic manufacturing.

12:34 pm – The finance minister proposed waiving basic customs duty on raw materials imported for manufacturing aircraft parts used by defence sector units.

12:32 pm – Basic customs duty exemption was proposed for the import of capital goods required for processing critical minerals within India.

12:32 pm – The government proposed extending the basic customs duty exemption on imports for nuclear power projects till 2035, covering all plants irrespective of capacity.

12:27 pm – The finance minister proposed raising the duty-free import limit for specified seafood processing inputs from 1 per cent to 3 per cent of FOB export value and extending the benefit to shoe uppers exports.

12:24 pm – FM Nirmala Sitharaman announced that the Income Tax Act, 2025 will come into force from April 1, 2026, with simplified rules and redesigned return forms to be notified shortly.

12:22 pm – The Union Budget proposed dedicated rare earth corridors in Odisha, Andhra Pradesh, Tamil Nadu and Kerala to strengthen domestic mining, processing and manufacturing capabilities.

12:21 pm – The fiscal deficit for 2026–27 was pegged at 4.3 per cent of GDP, with Rs 1.4 lakh crore proposed as tax devolution to states.

12:20 pm – The government announced a major infrastructure push with capital expenditure raised to Rs 12.2 lakh crore and proposals for freight corridors, high-speed rail, waterways and city economic regions.

12:17 pm – The finance minister announced the setting up of over 1,000 clinical trial sites nationwide and launched initiatives including Bharat Vistar and She Marts to support agriculture and women entrepreneurs.

12:16 pm – An outlay of Rs 20,000 crore over five years was proposed to support carbon capture, utilisation and storage technologies across sectors.

12.12 pm – Income Tax Act 2025 to take effect from April 1, 2026

The finance minister said the Income Tax Act, 2025 will come into force from April 1, 2026, introducing simplified rules, redesigned forms, lower TCS rates, new exemptions, and clearer TDS provisions to ease compliance and reduce ambiguity.

12.11 pm – Changes proposed in ITR filing timelines

FM Sitharaman proposed a staggered return filing schedule, retaining July 31 as the deadline for ITR-1 and ITR-2 filers, while allowing non-audit business entities and trusts to file returns up to August 31.

12.07 pm – Schemes announced to empower divyangjan

The finance minister announced the Divyangjan Skill Scheme for specialised industry-relevant training and the Divyang Sahara Scheme to strengthen ALIMCO through enhanced production, R&D and AI integration.

12.05 pm – Rs 1.4 lac crore allocated to states for FY 2026–27

FM Sitharaman said Rs 1.4 lac crore has been allocated to states for FY 2026–27 after accepting the 16th Finance Commission recommendation to retain 41 per cent vertical devolution.

12.04 pm – Fiscal deficit pegged at 4.3 per cent for FY 2026–27

Presenting Budget Estimates, the finance minister projected a fiscal deficit of 4.3 per cent of GDP, debt-to-GDP ratio of 55.6 per cent, total expenditure of Rs 53.5 lac crore and non-debt receipts of Rs 36.5 lac crore.

12.03 pm – Five medical tourism hubs and Biopharma Shakti announced

FM Sitharaman proposed setting up five regional medical tourism hubs and allocated Rs 10,000 crore over five years for the Biopharma Shakti programme to boost biologics, biosimilars and clinical research infrastructure.

11.59 am – Push announced for gaming, animation and AVGC sector

The finance minister said the AVGC sector is expected to need 20 lac professionals by 2030 and announced support for AVGC Content Creator Labs in 15,000 schools and 500 colleges.

11.58 am – Divyangjan Kaushal Yojana proposed

FM Sitharaman proposed the Divyangjan Kaushal Yojana to ensure dignified livelihood opportunities through targeted skilling and employment support for persons with disabilities.

11.56 am – Three new All India Institutes of Ayurveda proposed

The finance minister proposed setting up three new All India Institutes of Ayurveda, upgrading Ayush pharmacies and drug testing laboratories, and strengthening the WHO Global Traditional Medicine Centre in Jamnagar.

11.55 am – Capacity building AI missions proposed

FM Sitharaman said capacity-building AI missions will be launched with an outlay of Rs 25 crore to strengthen innovation, research and inclusive growth driven by emerging technologies.

11.51 am – Khelo India Mission to be launched

The finance minister announced the launch of the Khelo India Mission to transform the sports sector over the next decade and create employment and skilling opportunities.

11.47 am – High-level banking committee proposed for Viksit Bharat

FM Sitharaman proposed a high-level committee to review the banking sector for Viksit Bharat, while also announcing restructuring of PFC and REC to improve scale and efficiency of public sector NBFCs.

11.45 am – Rs 2,000 crore boost for micro-enterprise risk capital

The finance minister announced a Rs 2,000 crore top-up to the Self Reliant India Fund to support micro enterprises and mandated TReDS as the settlement platform for CPSE purchases from MSMEs.

11.43 am – High-powered panel proposed to link education with employment

FM Sitharaman proposed setting up a high-powered ‘Education to Employment and Enterprise’ committee to strengthen the services sector, assess AI’s impact on jobs, and drive growth, exports and employment.

11.40 am – Seven high-speed rail corridors proposed

The finance minister proposed developing seven high-speed railway corridors between major cities to act as growth connectors.

11.38 am – India Semiconductor Mission 2.0 launched

FM Sitharaman announced ISM 2.0 with an outlay of Rs 40,000 crore, along with the ‘Shakti’ initiative worth Rs 10,000 crore to deepen the semiconductor ecosystem.

11.37 am – New east-west freight corridor announced

11.30 am – FM emphasizes reforms and tables Finance Commission report

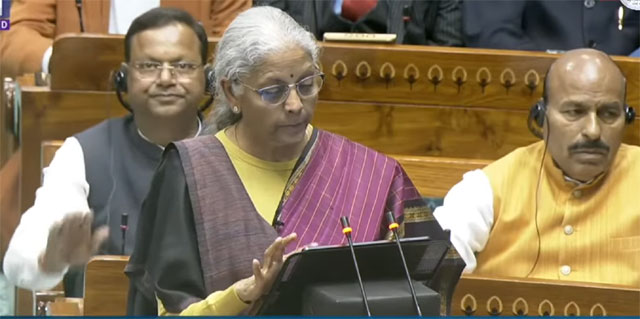

Union finance minister Nirmala Sitharaman said the government is prioritising reforms over rhetoric while presenting the Union Budget 2026–27 and tabled the 16th Finance Commission report outlining tax revenue devolution between the Centre and states for 2026–2031.

11.29 am – Capex proposed at Rs 12.2 lac crore for FY 2026-27

FM Sitharaman proposed increasing public capital expenditure to Rs 12.2 lac crore in 2026–27, announcing an infrastructure risk guarantee fund and accelerated asset monetisation through dedicated rights.

11.26 am – India will take confident steps towards Viksit Bharat

The finance minister reiterated that India will continue taking decisive steps towards becoming a Viksit Bharat.

11.24 am – ‘Reform express’ to keep government on track

Sitharaman said the government will press ahead with its reform agenda, highlighting over 350 initiatives including GST simplification, labour codes, quality control regulations, and deregulation efforts with states.

11.21 am – Action over ambivalence: six key interventions proposed

The finance minister outlined interventions across six areas, including scaling up manufacturing in seven strategic sectors, rejuvenating legacy industries, creating champion MSMEs, boosting infrastructure, ensuring stability, and developing city economic regions.

11.18 am – Four states to establish rare earth corridors

FM Sitharaman announced plans to support Odisha, Kerala, Andhra Pradesh and Tamil Nadu in establishing rare earth corridors, along with three dedicated chemical parks to enhance domestic production and reduce import dependence.

11.15 am – Semiconductor mission 2.0 launched

The government will expand India’s semiconductor sector under ISM 2.0, focusing on equipment production, design, supply chain fortification, and industry-led research and skill development.

11.13 am – Biopharma Shakti scheme announced

FM Sitharaman proposed the Biopharma Shakti scheme with a Rs 10,000 crore outlay to make India a global biopharma hub, including new NIPERs, upgraded institutes, 1,000 clinical trial sites, and strengthening regulatory oversight.

11.13 am – Union Budget 2026: People over populism, says FM Nirmala Sitharaman

Union finance minister Nirmala Sitharaman said the government has prioritised reform over rhetoric and people over populism, stressing that far-reaching structural reforms, fiscal prudence and monetary stability have been pursued while maintaining a strong thrust on public investment.

11:01 am: Union Budget 2026 proceedings begin in the Lok Sabha as finance minister Nirmala Sitharaman rises to present her ninth consecutive Budget.

Watch Live:

Earlier Report

Nirmala Sitharaman all set to present Union budget 2026

Daijiworld Media Network - New Delhi

New Delhi, Feb 1: Finance minister Nirmala Sitharaman is set to present her ninth Union Budget on Sunday, February 1, with the Centre expected to carefully balance higher growth ambitions with the need for fiscal consolidation amid global uncertainties.

For fiscal 2027, the world’s fastest-growing major economy is likely to prioritise defence, infrastructure, capital expenditure, power and affordable housing, while also outlining a clearer long-term economic roadmap.

This year’s Budget is expected to mark a departure from a long-followed convention. Traditionally, major policy intent has been laid out in Part A of the Budget speech, while Part B has largely focused on taxation. This time, Sitharaman is expected to use Part B to spell out a broader vision for India’s economic future, detailing both short-term priorities and long-term goals as the country advances further into the 21st century.

India’s economy has so far shown resilience despite external pressures, including punitive tariffs imposed by the United States under President Donald Trump. Growth for the year ending March 31 is projected at 7.4 per cent, supported by sustained government spending on infrastructure and earlier income and consumption tax measures that boosted consumer demand.

Rural development and agriculture are likely to receive special attention in Union Budget 2026. According to sources, additional allocations may be announced to expand employment opportunities in rural areas. The rural development ministry has sought a substantial increase in funding for the new employment guarantee programme, ‘Viksit Bharat – G Ram G’ (VB-G Ram G), proposing an outlay of Rs 1.51 lac crore, up from Rs 86,000 crore allocated to MGNREGS last year.

Continuing recent practice, the Budget will be presented in a paperless format, a system followed over the past four years. Sitharaman had, in her first Budget in 2019, replaced the traditional leather briefcase with a red cloth-wrapped ‘bahi-khata’ for carrying Budget documents.

On the fiscal front, the budgeted fiscal deficit for 2026 is estimated at 4.4 per cent of gross domestic product. Having reached a consolidation milestone with the deficit projected below 4.5 per cent, markets will closely watch for further signals on debt-to-GDP reduction.

Capital expenditure is expected to remain a key pillar of the government’s growth strategy. With capex for the current fiscal pegged at Rs 11.2 lac crore, the Budget is likely to retain its focus on infrastructure spending, with a possible 10 to 15 per cent increase in the capex target as private sector investment remains cautious.

The Budget may also propose measures to attract higher domestic and foreign investment. According to Reuters, the government is expected to consider easing norms to make it simpler for foreign companies to invest in defence firms holding existing licences.

Union Budget 2026 comes amid a complex global environment. While domestic demand has remained steady and inflation has moderated from recent highs, geopolitical tensions, volatile commodity prices and uneven monetary easing by major central banks continue to cloud the economic outlook.