In today's fast-paced world, making informed financial decisions is critical for long-term stability and success. Among the various financial tools available, a Gold Loan has become a preferred choice for many due to its simple eligibility criteria and quick disbursal. However, to maximise its benefits, planning ahead is key. That is where a Gold Loan calculator comes in. Using a calculator is convenient and lets you strategically improve your financial management.

Understanding a Gold Loan and the Role of a Calculator

A Gold Loan is a secured loan where individuals pledge their gold assets as collateral to avail of funds from a lending institution. The amount sanctioned depends on the value and purity of the gold, usually determined by the prevailing market rate. This type of loan is particularly helpful for short-term financial needs such as education, medical emergencies, business expansion, or family functions.

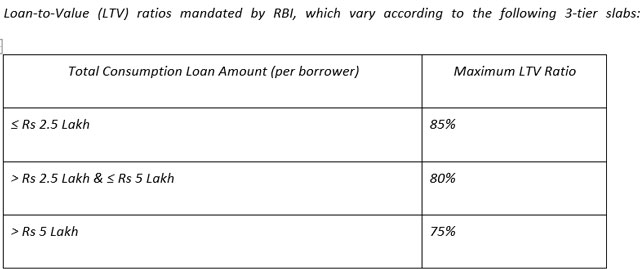

A Gold Loan calculator is an online tool that allows potential borrowers to estimate how much loan amount they can get based on the weight and purity of their gold, along with the applicable Loan-To-Value (LTV) ratio. Loan eligibility is subject to RBI-approved LTV limits and lender assessment of gold purity and weight. It also provides a clear picture of the monthly EMI (Equated Monthly Instalment) and interest payable over the tenure. The calculator provides an estimate; final loan approval depends on lender verification and credit assessment. It helps in the following ways:

1. Accurate Loan Estimation

One of the primary benefits of using a calculator is accurately estimating the eligible loan amount. It helps users avoid surprises when approaching a lending institution. You simply need to enter the weight of your gold. The calculator uses 22K as the default purity and determines the maximum eligible loan amount based on the current market price of gold. Gold rates fluctuate daily; the calculator reflects current rates and provides an approximate value, not an exact figure.

Using the calculator eliminates guesswork and ensures transparency in your financial planning. For example, if you own 50 grams of 22-carat gold and the current price is Rs 9,500 per gram, the calculator will show you the loan value based on the lending institution’s LTV ratio. The gold’s value is Rs 4,75,000, and the maximum loan you can borrow is Rs 3,56,250* as per the Loan-to-Value (LTV) ratio of 75%*.

2. Informed Comparison Between Loan Plans

With a number of loan plans available, it’s crucial to compare the offerings of lending institutions. A calculator helps you do just that. Compare loan amounts, interest rates, and repayment tenures across multiple lending institutions. Determine which institution gives you the highest loan for the same quantity of gold. Evaluate the impact of different interest rates and tenure lengths on your repayment obligations. When comparing loan plans, consider interest rates, processing fees, and other charges to make a fully informed decision, as these can significantly impact your total repayment amount. This kind of informed comparison helps borrowers avoid high-interest loans and opt for a transparent and fair-priced lending institution.

3. Helps Set a Realistic Budget

Another significant advantage of using a loan calculator is that it allows you to set a practical budget for loan repayment. You can adjust the loan amount and tenure to see how the EMI changes. If the EMI appears too high, you can opt for a longer tenure or borrow a smaller amount. This flexibility ensures that your loan EMIs do not disrupt your financial commitments. In this way, the tool facilitatesbetter debt management while preventing over-borrowing. Use the EMI estimates to budget responsibly, taking into account your other financial obligations. However, be cautious not to rely solely on the calculator for financial planning without considering your actual income, expenses, and overall financial health.

4. Easy and Instant Access

Most Gold Loan calculators are accessible online for free without requiring any logins or downloads. They are available on the websites of financial service providers, and you may use them anytime, anywhere, from a computer or smartphone. Once you enter the details, it offers results within seconds, making it a convenient tool for quick decision-making. This accessibility empowers you to make informed decisions without extensive financial knowledge.

5. Time-Saving and User-Friendly

Applying for a Gold Loan without calculating your eligibility or repayment plan beforehand often results in unnecessary delays. A calculator streamlines the process while saving time spent on manual calculations or bank consultations. It simplifies complex terms, like interest rate, tenure, and EMI, and provides visual representations through graphs or tables for better understanding. While calculators provide quick estimates, final terms should be confirmed with the lender before applying to ensure accuracy and avoid surprises. First-time borrowers find this information handy when applying for a loan. Calculators are best used in conjunction with lender consultations to finalise loan terms tailored to the borrower's profile and needs.

6. Promotes Financial Discipline

Another benefit of using a loan calculator is that it fosters financial discipline. It helps you visualise the entire repayment plan, allowing you to plan your finances accordingly. You can plan your monthly budgets based on the EMI generated by the calculator. Moreover, knowing the interest payable upfront discourages unnecessary borrowing. High gold values may tempt you to borrow more than necessary; use the calculator to plan responsibly and avoid over-borrowing even when your gold’s value increases. This proactive approach encourages borrowers to treat a Gold Loan as a responsibility, not just a convenience.

7. Customisation Options for Smarter Planning

Many online calculators come with customisation features that make financial planning more precise. You can input different gold weights, purities, tenures, and interest rates to view multiple scenarios. Some calculators even offer sliders and drop-down menus to make this easier. These simulations help in choosing the best combination of loan amount and tenure based on your needs. With such interactive tools, you gain better control over your borrowing decisions.

Customisation helps plan better, but actual repayment may include extra charges such as processing fees, insurance, storage fees, and prepayment penalties, which are not reflected in the calculator. Borrowers should always review the Key Fact Statement (KFS) and loan agreement to understand the complete cost structure before finalising a loan.

8. No Impact on Credit Score

Using a Gold Loan calculator does not contain any risk. Unlike a loan pre-approval or application, using a calculator does not involve a credit check and does not pre-approve the loan, it only helps estimate eligibility safely. You can experiment with various scenarios without any consequences to your credit history. This enables you to explore your options thoroughly before committing. The calculator is a safe tool to plan wisely, especially for borrowers concerned about maintaining a good credit score.

9. Better Understanding of Loan Costs

Borrowers often overlook the total cost of a loan. A calculator ensures you have a complete picture by breaking down the interest payable over the loan tenure. It shows how the tenure duration affects the total cost in the long run and invites the users to opt for a repayment scheme that is cost-effective as well as efficient. The total cost may vary depending on the tenure selected, interest rate offered by the lender, and any additional charges. Furthermore, interest rates can vary based on the loan tenure, borrower profile, and lender policies, all of which may influence the total repayment cost. This openness is crucial in avoiding financial liabilities in the future.

10. Ideal for Emergency Situations

In emergency scenarios where time is of the essence, a loan calculator can be a lifesaver. Whether it's a medical emergency or urgent business capital requirement, the tool gives instant insights. You can make decisions immediately without having to wait for consultants or bank officials. It prepares you for documentation and negotiation even before you visit the office of the lending institution. Even in emergencies, you will need to complete the required documentation and gold appraisal before funds are released. This speed and preparedness can make all the difference during financial crunches.

Conclusion

A Gold Loan is one of the quickest and most accessible ways to unlock the value of your gold assets. However, borrowing without adequate planning can lead to unnecessary stress and financial strain. That’s where the importance of a Gold Loan calculator truly shines. It helps you borrow wisely, repay comfortably, and manage your finances responsibly. Many lending institutions offer attractive interest rates*and easy-to-use digital tools, including an online loan calculator.