November 2, 2025

Well, if there is something that has kept me on watch for a while and also at times created qualms of my understanding the fundamentals of investment, it is the Bitcoin aka crypto currency. You may hate it or dislike it but definitely cannot ignore it. A great write up from the Mint edition was able to give me some solace which I thought of recreating for you.

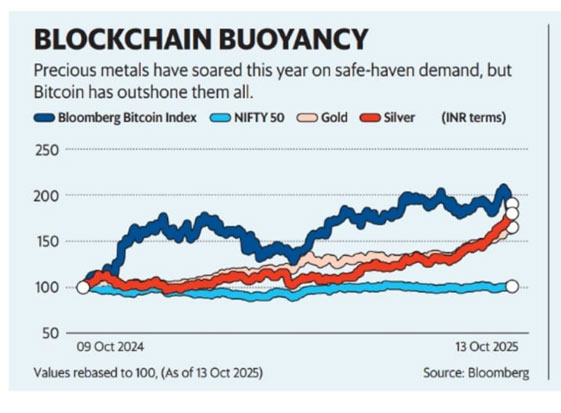

Ever since Trump started blowing his own trumpet on tariffs, the Bitcoin has risen 90% in USD terms. This is in sharp contrast to the Indian Nifty index which has practically delivered nil returns for the past 12 months. Some portfolios with a bias towards mid & small caps are now in deep red. And guess, what? The recent surge in the rally on Bitcoins has even surpassed even gold prices which now looks dwarfed with a 50% return in the past 12 months (in USD terms).

?

??Bitcoin vs Nifty Vs Gold Vs Silver

It is not surprising to see both Bitcoins and Gold surge when equities are languishing. Unlike equities, both Bitcoins and Gold don’t have any book value nor corporate earnings to justify their price movements. The duo also belongs to the coveted gang of limited supply wale. The estimated supply of Bitcoins in existence is said to be 21 million coins. And if its partner in crime, Gold, had to be measured, it would look like a 7- storied building 70 ft tall, if all the available gold bars & coins, jewellery (2,16,265 tonnes), were to be piled up together. The price for both is rising as more investors want a grab of the limited quantity. This is where the similarities end as Bitcoin is relatively a new found destination for the hunger struck new generation to find value in something conceived out of block chain technology and whereas, Gold has been part of mankind ever since its first discovery during the Palaeolithic era, around 4000 B.C. a region which we know as Bulgaria today.

Bitcoin initially considered speculative is today gaining acceptance as a digital currency and is mocked as digital Gold. It had its own share of woes when its wallet partner Silk Road was banned by the FBI in 2013, China banning crypto mining coupled with the collapse of Mt. Gox, the world's largest crypto currency exchange. Bitcoin could gain legitimacy only in 2021 when El Salvador accepted it as legal tender. In the year 2024, the US Securities Exchange Commission (SEC), the counterpart of SEBI, approved Bitcoin ETFs. The Czech Central Bank is now considering stashing away billions of Bitcoins as part of its reserves. Deutsche Bank has predicted that Bitcoins will be part of many Central Bank’s reserves in a decade. This might come as a rude shock to the US dollar’s status of reserve currency. China has already reduced its holding on the US dollar by 59 billion USD to 759 billion USD in 2024.

India’s stance on Bitcoins has mellowed from being a cautionary mode to now being accommodative. It does not recognise it as legal tender (as yet) but has mandated tax applicability at 30%+ on its gains. This is an indirect endorsement. I acknowledge your presence but I don’t like you, hence I will tax you. An estimated turnover of 300 billion USD was recorded between July 2023 & June 2024. This translates to 13% of the total trading volume of the Asia Pacific region which places India on the top. Even though the volumes are riding high on the euphoria of the rise in valuation of 10,000 bitcoins from a meagre 40 USD in 2010 to 1.2 billion USD today, it has also borne higher volatility than equities. The reason I mentioned 10,000 bitcoins in 2010 is that there was a programmer based out of Florida named Laszlo Hanyecz who paid for his meal that day in 2010 with 10,000 bitcoins and it became the first documented transaction for Bitcoin. The meal was two large pizzas and the cost of heart burn in 2025, priceless.

I’m highlighting these statistics to prove a point that Indians do have an appetite for risk. But not for the suitable products. There is a section of the population which partakes not only in Bitcoins but also in Futures and Options without understanding what derivatives actually mean. There is a similar tribe that participates in Ponzi schemes where an estimated Rs 1,20,000 Crs has been lost. The losses incurred by individual F&O traders in FY 25 was Rs 1,05,603 Crs where 91% of the traders incurred losses. And for those of you who are not aware that Bitcoins are not under the purview of SEBI, Good Morning! SEBI not only regulates India's securities market but also protects investors, promotes the market's development, and regulates its participants. So tomorrow if I have any grievance on Bitcoin there is no one to listen. It is like entering the old buildings in Mumbai which have the board stating, enter at your own risk.

?Picture only for representation

I have come across many fellow Mangaloreans placing their hard-earned money with individuals for earning higher interest, typically around 5 to 7 % higher than the prevailing fixed deposit rates. I know a few who have opened their treasury to the lure of 24% p.a. returns as well. And they seem to be very happy to receive the sadthik vaad aka higher interest without even understanding how the borrower is generating this higher interest. My only question to such happy lenders being, are you sure whether the borrower is paying your so-called higher interest by generating additional revenues or from the same principal amount that he has borrowed. If some is paying me 24% p.a. on a monthly mode, he should either be either generating more than 24% p.a. from his venture, or maybe he must be paying the higher interest from the principal amount itself or borrowing at a cost more than 24% to service the existing loan. While those last two options spell doom for the lender, the first one increases the author’s curiosity.

I’m not playing the role of a cop nor of the regulator, but at times, I’m perplexed to hear from the same fellow Mangaloreans cribbing that Mutual Funds (MFs) are risky. Of course, Mutual Funds are risky, their valuations fluctuate based on the fluctuation of the underlying assets. The more volatile being equity MFs than its step brother debt MFs. Equities are definitely volatile in nature; there are numerous traders and investors buying and selling every second. But at the same time, equities are backed by businesses that generate revenues, own plants and machinery, have book value and also display transparency in their annual reports. Mutual Fund companies also have strict compliance in place ensuring transparency of the investments, NAV’s being declared daily, factsheets being reported monthly, some daily too, and most importantly governed by a regulator called SEBI. In the event of an unresolved grievance from the fund house, the unit holder can approach SEBI and lodge a complaint on its digital platform SCORES (SEBI Complaints Redress System).

As a practitioner of investment related products like MFs, I don’t claim to be a risk mitigator, rather I call myself as a risk manager. My job is to understand the client’s risk appetite and their time horizon and then suggest the solution. Just like a doctor cannot keep the vaccine ready for the patient before examining the patient, a true financial advisor needs to, first diagnose the objective of the client's investment, his risk appetite and time horizon. And as an investor, one must enter into the product only after understanding its features, whether it matches your objective, is there data to match the sales pitch and importantly does it suit your profile. Bitcoins need a special hearing here as they are currently not under the purview of SEBI. You might be proven right later, but today you are like a batsman entering the cricket field without your abdominal guard. You can enter, but at your own risk. To sum it up I would say that investing in something which you don’t understand will only lead you to Hotel California, you can check out anytime but you can’t leave.