Financial independence is not just about earning—it is about having the freedom to plan, save, and grow your wealth steadily. As India marks another Independence Day, many individuals are reflecting on how to build long-term financial security for themselves and their families. One effective way to start is by investing in Fixed Deposits (FDs), especially if you are looking for stable, monthly returns.

FDs continue to remain a popular savings tool across all age groups in India. With interest rates trending upwards in 2025 and festive offers available online, now is a practical time to explore the best options available. If you are planning your next move, using a FD monthly interest calculator can help you estimate your monthly income and choose the right plan.

Why fixed deposits continue to be relevant

FDs offer a level of certainty that many other investment instruments do not. Whether you are a young professional looking to build savings or a senior citizen seeking regular income, FDs provide:

- Fixed interest throughout the tenure

- Full capital protection with no market-linked risk

- Freedom to choose cumulative or non-cumulative payout options

- Tenure flexibility, from 12 to 60 months

In particular, the monthly payout option is suitable for those who need regular income to manage household expenses, supplement pensions, or plan for predictable short-term goals.

Planning finances around monthly returns

With inflation remaining a concern in 2025 and household budgets tightening, monthly interest from FDs can be a dependable source of income. Unlike equity dividends or rental income, FD interest is fixed and not influenced by external market conditions.

For instance, someone investing Rs. 5 lakh in a non-cumulative fixed deposit with a monthly payout can use a FD monthly interest calculator to view how much they will earn every month based on their tenure and rate of interest. This makes financial planning easier and allows investors to match income with expenses more accurately.

Best FD interest rates in India

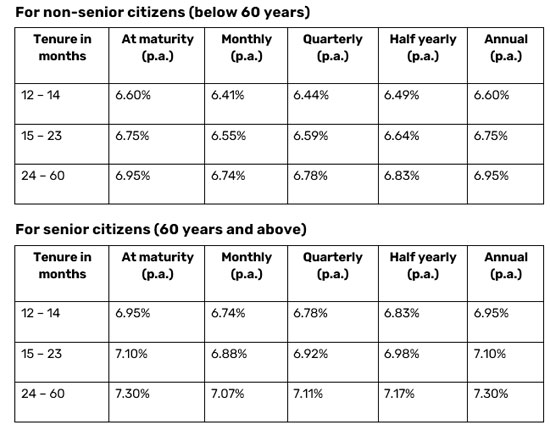

When it comes to choosing a deposit scheme, it helps to compare the best FD interest rates in India. Bajaj Finance offers attractive rates, and all deposits can be booked online, making the process quick and secure.

These rates apply to deposits from Rs. 15,000 to Rs. 3 crore. Customers booking online can also benefit from a smoother KYC and payment process.

How to use an FD monthly interest calculator

Before investing, it is helpful to calculate your monthly interest to understand what to expect. An online FD monthly interest calculator helps you do this within seconds.

You only need to enter:

- Your deposit amount

- Preferred tenure (e.g., 12, 24, or 36 months)

- Interest payout frequency (choose “Monthly”)

- Your age (since senior citizens receive higher rates)

The calculator then displays your expected monthly earnings. This is especially useful if you are planning retirement income or looking to meet fixed monthly expenses.

Invest online in a few easy steps

Bajaj Finance makes it easy to open an FD from anywhere in India through a paperless process. Here is how to get started:

- Visit the official Bajaj Finserv Fixed Deposit page

- Enter your mobile number and verify it with OTP

- Choose the deposit amount, tenure, and interest payout (e.g., Monthly)

- Complete KYC using Aadhaar and PAN via DigiLocker or CKYC

- Make your payment via UPI, NetBanking, or NEFT

Your FD confirmation and e-receipt will be sent within three working days.

Investing during the festive season

August brings more than just Independence Day. With Ganesh Chaturthi approaching, many families are also focusing on fresh starts and financial discipline. Known as a festival that celebrates wisdom and prosperity, this is often considered a good time to begin new ventures—including investments.

Starting a fixed deposit during this season can serve as a practical and symbolic step towards financial stability. It combines tradition with foresight, especially when the goal is to create a secure financial base for future needs.

Conclusion

This Independence Day, take a meaningful step toward your own financial freedom. Whether you are looking to supplement income or simply grow your savings, fixed deposits offer a safe and predictable way forward.

With access to some of the best FD interest rates in India, a wide range of tenures, and monthly payout options, Bajaj Finance Fixed Deposits meet the needs of both new and experienced investors. Use a FD monthly interest calculator to plan smartly, choose your tenure wisely, and begin investing with confidence.

Let the spirit of the season guide you—towards wise choices, stable returns, and a more secure financial future.